Medical device localisation is essential to meeting a target market’s linguistic, cultural and regulatory requirements. Struggling to navigate the complex regulatory landscape of international medical device markets? Worried about the accuracy and effectiveness of your translated user manuals and labelling? Facing delays and setbacks due to inefficient localisation processes? This...

Gallagher: Cyber Defence Check

Book a free 30 minute consultation with one of Gallagher’s specialists for a review of your cybersecurity. In fast-moving sectors such as life sciences and medical technology, the risk of cyber-attacks on individuals and businesses is greater than ever. There are a number of methods cybercriminals use to exploit businesses....

Pioneer Group and CPI collaborate on ‘Golden Ticket’ programme for planetary health innovations

Pioneer Group, a company combining laboratory development and operation with venture building, has teamed up with CPI, the independent deep tech innovation organisation, to launch a Golden Ticket programme for innovations in planetary health. The 2024 Golden Ticket Programme is open to hydrogen and climate technology companies that are innovating...

From Quishing to Cookies: How to Understand and Defend Against Advanced Social Engineering Attacks

Social engineering attacks, also known as ‘human hacking’, are becoming increasingly sophisticated, with cybercriminals finding new in-roads to harvest sensitive data. Techniques such as phishing and spear phishing are responsible for the majority of social engineering cyber-attacks. They are designed to manipulate employees to share personal data or credentials, which...

Global Incubator Programme: business acceleration for SMEs

The Global Incubator Programme is an acceleration programme for innovative SMEs to grow and scale through exploring the potential of global markets. Are you ready to scale your business globally? To successfully scale your business globally you need to understand the requirements of different markets and build the necessary partnerships, collaborations, and...

NHS England has announced the third round of the NHS Cancer Programme Innovation Open Call

The NHS Cancer Programme invites innovations or new approaches that will detect cancers earlier and increase the proportion diagnosed at stage one or two. The competition aims to fast-track high quality, proven, late-stage innovations into front-line settings, as well as address implementation evidence gaps. Innovations will be 100% funded up to...

New funding programme launched to accelerate healthcare innovation in the East Midlands

Medilink Midlands and Health Innovation East Midlands (formerly East Midlands Academic Health Science Network - EMAHSN) have joined forces to launch a new programme designed to support and accelerate healthcare innovation in the region. The Health Innovation Fund offers support of between £5,000 and £10,000 to enable East Midlands-based SMEs or...

Place Based Impact Acceleration Account: East Midlands Emerging Research Growth for MedTech Enterprise (EMERGE)

What is a Placed Based Impact Acceleration Account (PBIAA)? In October 2023, the Engineering and Physical Sciences Research Council (EPSRC) released a call for round two of their PBIAA scheme, which is intended to enhance the capabilities of research and innovation clusters across the UK to drive economic and societal...

Nine coveted awards up for grabs at Medilink Midlands Business Awards 2024

Applications are now open for Medilink Midlands’ Business Awards which will once again celebrate the work and achievements of life sciences companies across the Midlands. With nine categories from Start-Up to Outstanding Achievement, the 2024 awards are set to be bigger and better than ever and will highlight some of...

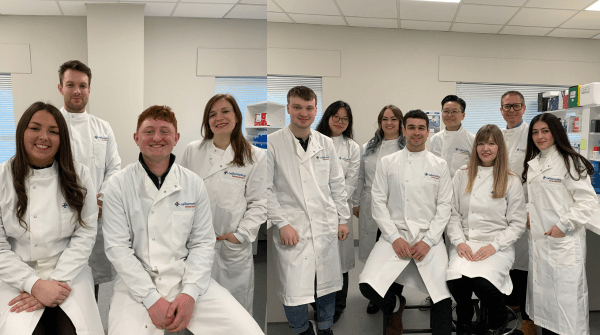

Influx of promotions and new starters at Cellomatics signals next successful phase for award winning business

Specialist preclinical contract research organisation (CRO) Cellomatics Biosciences has heralded the start of its next successful phase with four promotions and eight new arrivals. Dr Shailendra Singh, CEO of Cellomatics Biosciences, comments: “Capitalising on our existing strengths and internal team expertise, we intend to further consolidate our position as a...